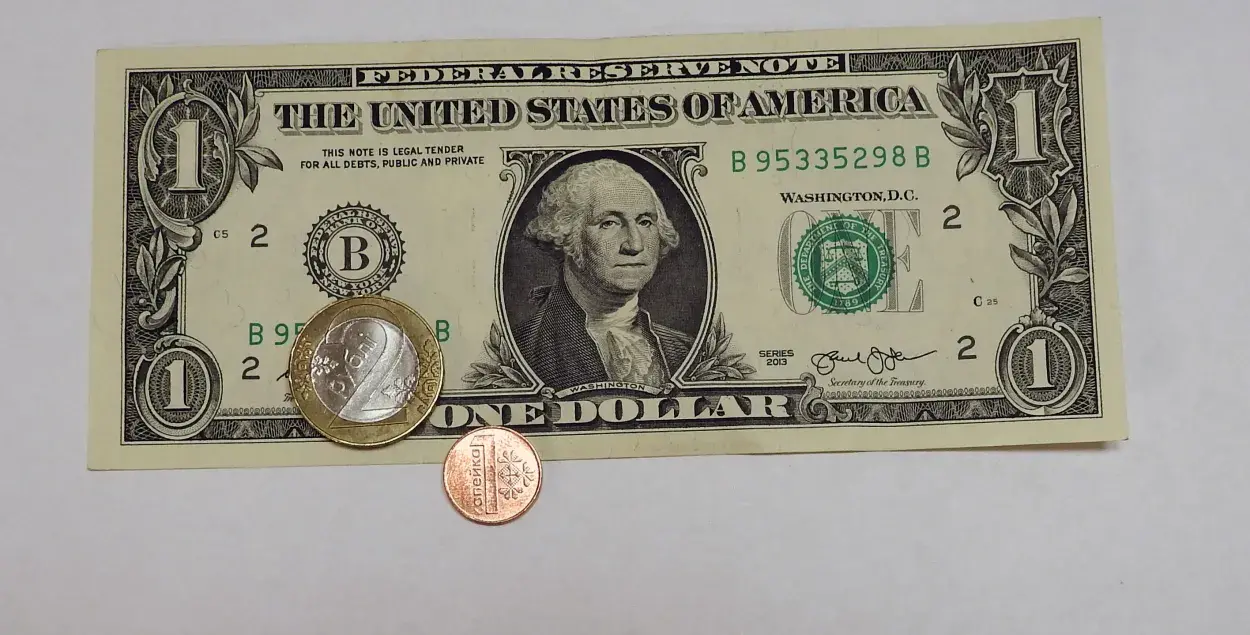

Dollar breaks BYN2 barrier: what's next?

Photo: Euroradio

The US dollar exchange rate in Belarus on Wednesday broke the psychological barrier of BYN2 when it closed at BYN 2.0057 - a new annual high. However, Vadzim Yossub, chief expert at Alpari, tends to calm our listeners down; he says nothing extraordinary has happened.

“The currencies basket has grown marginal 0.04%, with some of the currencies influnced by what is happening at external markets. There are basically two trends at the moment. On the one hand, Euro is continuing growth against the US dollar in the world (it has gained 2 US cents within the past 24 hours). Simultaneously, Russian ruble is falling. Both Euro and US dollar have grown in Russia back to the August 2017 level. Theoretically, Belarusian ruble remains stable while US dollar and Euro on the one side and Russian ruble on the other side are moving in the opposite directions."

In the view of Vadzim Yossub, Russian ruble's fall has been caused by non-economic factors, because there is no connection with the cost of crude oil. In the past several days, Brent oil traded at a relatively high price - over $61 per barrel.

“Some people also suggest that towards the end of the year big Russian companies have to make huge payments on foreign currency loans. Hence, they are buying hard currency in large volumes. On the surface, there is also yet another explanation why Russian ruble has plunged - anticipation of fresh US sanctions. Summing up, since the causes are not economic, it is hard to forecast how much longer the Russian ruble will continue falling," Vadzim Yossub says.

Economist Leanid Zaika is convinced that the current devaluation of the Russian ruble will affect Belarusians badly.

“Since Russia is reacting in a more flexible way to the current situation, it will be increasingly more difficult for Belarus to maintain a fixed exchange rate. But the main thing is that a weaker Russian ruble means that Belarusians exports automatically become more expensive. We have had a good spell at external markets recently with exports having grown 19%. However, the situation will be developing in a usual way. We will have to cut expenditures to make our products competitive. That is something that industrial enterprises have to do," Leanid Zaika explains.

In the view of Vadzim Yossub, US dollar will stop growing in Belarus after the fall of the Russian ruble ends. Therefore, there are no serious reasons to be worried.

"An average Belarusian does not have to run to exchange offices because there are no excessive Belarusian rubles in the pockets. This is good. This is the factor that will not allow the currency market to collapse in Belarus," Vadzim Yossub sums up.

If you have decided to exchange Belarusian rubles to foreign currencies, Leanid Zaika advises to buy US dollars and euros in equal shares. That way, no attention can be paid to the fight between these two currencies, the economist reckons.