Why does National Bank need a blockchain?

Photo: Bitnovosti

The National Bank of Belarus has announced the mainstreaming of the blockchain technology, causing people who deal with finances and new techniques to post joyful reactions on social media. Why are blockchain cool and what is needed for? Euroradio has asked senior analyst at Alpari Vadzim Yossub.

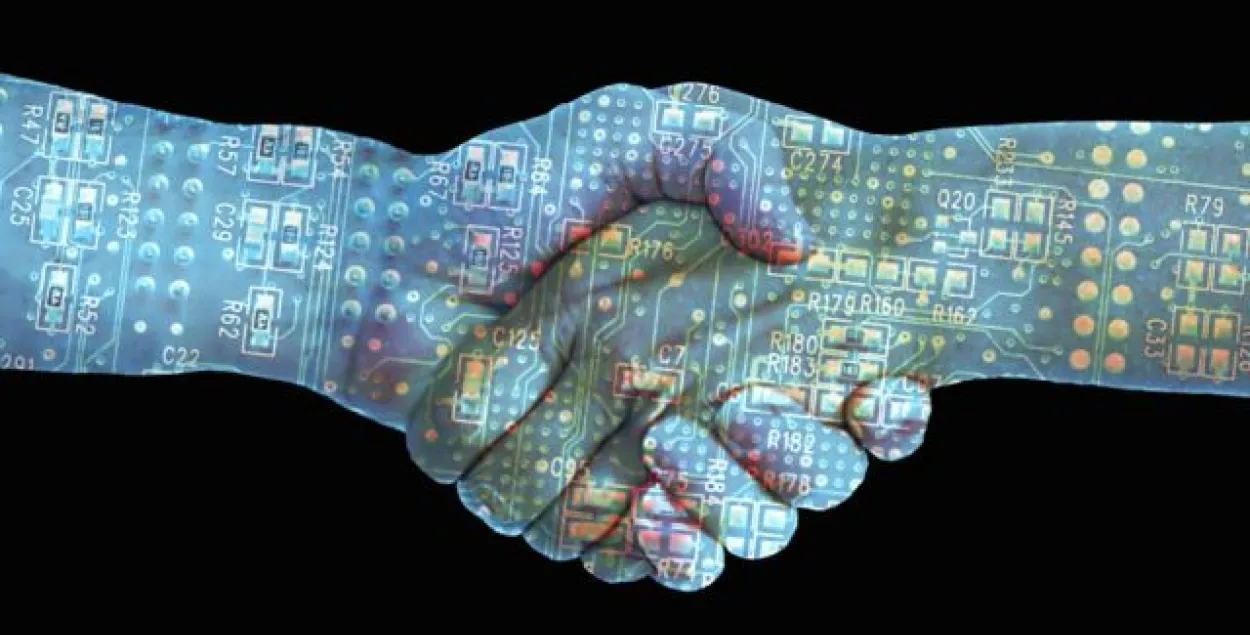

Decentralization. Until now, all kinds of information, including banking data, was stored in Belarus in a centralized manner. For example, information about the bank accounts of clients was stored at a bank's computers. Information about the accounts of banks was stored at the database of the National Bank. However, such a centralized system of data storage is vulnerable.

"Theoretically, a centralized database can be compromised by the information owner," Youssub explains. For example, a bank employee who has access to a bank's computer can theoretically steal the money of clients by wiring them to his own bank account. Such cases did happen. The centralized data storage system can also be attacked by hackers."

In contrast to a centralized data storing system, a blackchain unites around itself several equal participants. Information about contracts, money, insurance and so on is simultaneously stored on the computers of every participant of the system.

"...Not on a central server, which can be compromised or hacked," Vadzim Yossub continues. Any changes of this information - for example, someone wired money to another or signed a contract - take place in the database and simultaneously on the computers of all participants. In other words, it is more reliable and secure from hacker attacks and human-induced accidents. Information will live untill there are two working computers while other computers became inactive. One can also be quite certain that illegitimate changes or interference are not possible simultaneously on all computers in the system.

In the view of Vadzim Yossub, it is still early to say that blockchains as a data storing method will win all other technologies but it is a trend now and it is wonderful that the National Bank enters this field in a timely manner.