Belarus one step away from financial crisis - World Bank envoy

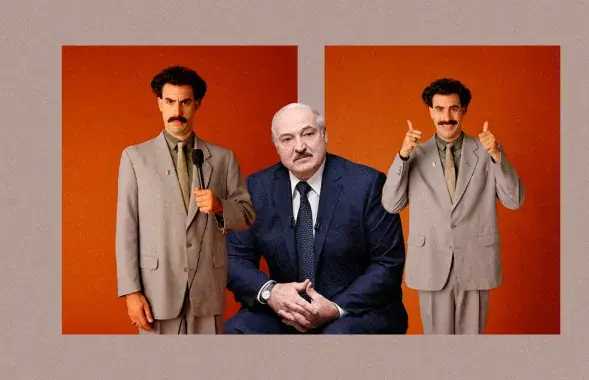

World Bank Country Manager for Belarus Alex Kremer

Belarus is one step away from the financial crisis, today it can be compared to a family that spends more than it earns, the head of the World Bank office in Belarus Alex Kremer said on September 3.

He explained that the crisis occurs when there are problems in the relations with lenders. In order to avoid it, reforms should be implemented, but the first step would be to carry out an independent assessment of state-owned enterprises.

"When a family spends more than it earns, it goes through three stages," says Alex Kremer. "The first is the stagnation phase. Prospects for income growth will be low if the economy is not restructured, as the World Bank said two years ago. The next stage is vulnerability to the resulting debt. Belarus is at this very stage. The third phase is the financial crisis."

Why Belarus has become vulnerable to debt and what it risks

Before solving the problem, we need to figure out the reasons for it. Alex Kremer says that Belarus has become vulnerable because of foreign currency borrowings. First of all, it's because of the state-owned enterprises, which have accumulated debts in foreign currency to cover the losses from the previous periods. In addition, Belarus took government external loans in foreign currency.

"State enterprises may find themselves in a situation where they won't be able to repay their debts," says the representative of the World Bank. "The second risk is related to the fact that the financial banking sector may find itself in a situation where it can no longer manage its balance sheet. Another risk that the National Bank may face is as follows: due to external pressure, it won't be able to contain the loss of its foreign currency reserves."

The recession in the global economy, which is now being discussed more and more often, will have a negative impact on the inflow of foreign currency into the Belarusian economy.

"As the experience of 2008 showed, the recession in the global economy may have another effect," explains Alex Kremer. "International lenders tend to withdraw their funds from emerging markets, transferring them into more reliable assets such as gold and financial assets of the developed countries."

The expert notes that the economic disagreement between Belarus and Russia affects not only the balance of payments but also the financing. From 2018 to 2022, more than 65% of the debt repayment by Belarus will be related to the repayment of debt either to Russia or the Eurasian Development Bank.

"Spend less, earn more"

"To spend less, to earn more," this is the advice the World Bank gives to the Belarusians.

Alex Kremer recalls that the monetary and fiscal policy of Belarus has been significantly tightened in response to the 2015-2016 recession. As a result, private-sector borrowing has been significantly reduced: far fewer companies take bank loans to finance their investments. Therefore, on the one hand, it is vital for the National Bank to continue to restrain the growth of lending, while on the other hand, the possibility of further tightening is rather limited.

As for the fiscal part, Alex Kremer congratulated the Ministry of Finance on the fact that "it has managed to stabilize the budget deficit in a rather difficult situation."

The expert is convinced that now is not a good time to soften the fiscal policy. "The family [of Belarus] should not borrow fresh funds at a time when the debt is already high," he said.

It's time to deal with state enterprises and help the unemployed

The representative of the World Bank is confident that Belarus has opportunities to optimize public spending. As for "spending less," in our recommendations we talk about subsidizing heating supply and tax benefits," Alex Kremer says. "Speaking of the need to "earn more," we mean structural reforms that will free up the growth potential of the country."

According to the World Bank, Belarus needs, first of all, to restructure the state enterprises sector. It has a great weight in the economy but often uses labor resources unproductively. One should start by classifying state enterprises and dividing them into groups: enterprises that operate normally, enterprises that can be corrected very quickly in case of financial restructuring, enterprises that have no commercial future and need to be liquidated, and those that may have a commercial future in case of privatization.

The World Bank's recommendations are often presented as a caricature, as recommendations to privatize or liquidate everything," the expert complains. "But this is not what we mean. Such a classification of state enterprises should be made by some objective independent entity because if it is done by institutions that have a strategic interest, there will be no results from such work."

The economist realizes that the restructuring of state-owned enterprises will lead to a reduction in jobs. But this should not stop you, because people should have a real job and get paid for it rather than help the state create a picture where there is no unemployment. The World Bank recommends strengthening the national social aid programs by creating a reliable program to help the unemployed.

Alex Kremer spoke at the media breakfast "Reforms for 100 billion", which was organized by the IPM Research Center with the financial support of the European Union.